Which Of The Following Is An Example Of Formal Management Controls?

Near faster than you can say marking-to-market accounting, direction controls disappeared once Jeff Skilling became CEO of Enron. The rest is distressing history and a shareholder's worst nightmare come true. These authors certificate the subversion of Enron's management controls and suggest the lessons managers tin can learn from the worst fiscal plummet in U.Due south. corporate history.

The plummet of Enron has been described every bit offering the aforementioned sort of opportunity for reflection for the business community as the Challenger disaster did for the engineering profession or September eleven did for political scientists. This article draws on a vast database of public records, testimonies at the various Enron-related trials and insider accounts concerning Enron's ascension and fall to answer the question: how did a sophisticated and comprehensive set of direction controls fail to preclude and notice widespread and connected corporate-wide fraud, information manipulation and dishonesty.

Throughout the Enron mail service-mortem, financial accounting irregularities and the audacious use of special purpose entities for off-balance sheet financing purposes have been the focus of attending. Seldom best-selling is the fact that Enron had in identify a comprehensive, state-of-the-art and honor-winning management command and governance system, and that during Richard Kinder's term as president from 1986 to 1996, Enron operated with a highly effective management command arrangement.

This commodity focuses on the cultural surround surrounding Enron'due south management control systems, and the influence of a powerful-take a chance taking culture on Enron'southward controls. Robert Simons' work on direction control underscores the need to contain culture in understanding direction command systems. Research conducted by leading organizational psychologist Edgar Schein also suggests that a stiff link exists between executive leadership actions and the nature of an organization'due south culture. Accordingly, in this commodity nosotros highlight the disquisitional office that leadership and culture play in the success and effectiveness of management control systems inside organizations.

Enron provides a blueprint of how bereft attention to changes in leadership and culture tin undermine what, at least on the surface, appears to be a land-of-the-art management control system. While many companies may claim to accept sophisticated direction controls, the ultimate effectiveness of such controls is highly dependent on an arrangement'southward civilization and leadership. The perversion of this control infrastructure under the leadership of Jeffrey Skilling offers vital lessons about the operation of management control systems in large, circuitous organizations. Agreement these lessons is crucial in ensuring that Enron's plight is not replicated.

Enron Corporation was born in the middle of a recession in 1985, when Kenneth Lay, CEO of Houston Gas Visitor, engineered a merger with Internorth Inc. The new company, which reported a first year loss of $14 million, consisted of $12.1 billion in assets, fifteen,000 employees, the nation'south 2d-largest pipeline network, and a towering mountain of debt. Enron was a typical natural gas firm with all the traditional trappings of a highly leveraged, "onetime economy" house competing in the regulated energy economic system. Teetering on the verge of bankruptcy in its early years, Enron had to fight off a hostile takeover attempt. It likewise incurred embarrassing losses on oil futures, which its traders in New York covered upwards in their reports to the Houston headquarters. Its old economic system strategy did not excite the stock market. This would change dramatically, still, during the 1990s, when Jeffrey Skilling replaced Richard Kinder equally the CEO.

Richard Kinder, known throughout Enron as "Doctor Discipline", was both people and numbers oriented. He held a meeting in the boardroom every Monday morning where he interrogated every business unit of measurement leader, ofttimes challenging their strategic plans and numbers. He focused militarist-like on expenses, greenbacks flows, and employee levels. Greenbacks direction was so of import for Kinder that he gave all business organisation group managers a budget target for cash flow and profits, with bonuses tied to meeting both targets. While Kinder demanded performance, he was too realistic, frequently telling business unit of measurement leaders who submitted overly optimistic proposals not to start "smoking our own dope." Too every bit enervating field of study with respect to numbers, he was also people oriented, creating a collegial, family-similar environment, with a respect for all.

With the appointment of Skilling as CEO, Enron's civilization would begin a radical transformation. Past 2000 it had become "the star of the New Economy," emerging every bit a paragon of the intellectual majuscule company with an enviable assortment of intangible resource, including political connections, a sophisticated organizational structure, a highly skilled workforce of sophisticated financial musical instrument traders, a state-of-the-fine art information system and good accounting knowledge. In 1999, Enron was named by Fortune as "America's Almost Innovative Company," "No.one in Quality of Management," and "No. 2 in Employee Talent." An regular army of scientists, business organization people and academics sabbatum rapt as Skilling – "The #1 CEO in the U.s." – proselytized at technology and leadership conferences beyond the U.s. about how Enron was not only embracing innovative theories of business just also making a lot of money doing so.

However, in late 2001 Enron appear that considering of bookkeeping errors it was reducing its later-tax internet income past a total of over $1 billion and its shareholders' disinterestedness by $1.7 billion. On December 2, 2001, Enron, with avails of $63.iv billion, became the largest corporate bankruptcy in U.Southward. history, triggering a collapse in investor confidence and opening a Pandora'southward Box of problems relating to corporate governance, accounting and regulation.

Commentary on the Enron scandal has tended to focus on a number of fiscal reporting bug including auditor independence, special purpose entities (SPEs) and the appropriateness of its accounting. A host of solutions accept been proposed with respect to these issues, including greater shareholder empowerment, shareholders' boards of trustees, privileging accounting principles over accounting rules, a reduction of exterior regulation of accounting practices and requiring auditors to judge the substance of disclosure (and, of class, most notably the Sarbanes-Oxley legislation). All the same, the role of management control systems – and more importantly, the affect of leadership and culture on such systems – in the Enron plummet has largely been disregarded.

How fraud occurs within organizations can be understood by examining the elements that comprise such actions. At an individual level, SAS No. 99 (Consideration of Fraud in a Financial Statement Audit) issued past the Auditing Standards Board indicates that the occupational fraud triangle comprises three conditions that are generally present when a fraud occurs. These conditions include an incentive or pressure that provides a reason to commit fraud (personal financial issues or unrealistic performance goals), an opportunity for fraud to be perpetrated (weaknesses in the internal controls), and an attitude that enables the individual to rationalize the fraud. While the fraud triangle focuses on private-level constructs of fraud, such as localized instances of cash or other nugget appropriation by employees, the Enron example highlights fraud at the organizational level – systemic organization-wide fraud and abuse. At the organizational level, leadership, organizational culture and management command systems course the three points of the organizational fraud triangle shown below.

The fraud triangle illustrates that the nigh of import lessons from Enron lie in the way that a corporate culture championed past CEO Skilling overcame a sophisticated and widely lauded set up of direction controls and in the importance of carefully balancing the core concepts of leadership, organizational civilisation and control within organizations. Arrangement-broad fraud is but possible when these three variables are configured in a style that enables – and even fosters – manipulation and fails to forestall compliance failure. The linkages presented in the diagram above provide managers in other organizations important, yet largely untold, insights into Enron's demise.

Linkage 1: Enron'due south sophisticated management controls at the time of its plummet

Controls form the cauldron in which Enron's innovative energies circulate (G. Hamel, Leading the Revolution, Harvard Business School Printing)

Management controls refer to the tools that seek to elicit behavior that achieves the strategic objectives of an system, such as budgets, performance measures, standard operating procedures and functioning-based remuneration and incentives. While Enron'south demise has been portrayed equally resulting from a few unscrupulous rogues or 'bad apples" (the phrase used by President Bush-league) acting in the absence of formal management controls, Enron featured all of the trappings of proper direction control, including a formal lawmaking of ethics, an elaborate functioning review and bonus government, a Run a risk Assessment and Control group (RAC), a Large-5 accountant, and conventional powers of boards and related committees. This command infrastructure was widely lauded right upward until the demise of the company.

The three core pillars of Enron'due south management control organization were the risk cess and control group, Enron's operation review arrangement and its code of ethics.

Risk Assessment and Control Grouping: An integral part of Enron's direction command organisation was the Gamble Cess and Control group (RAC). RAC was responsible for approving all trading deals and managing Enron's overall risk. Every bargain put together by a business unit had to be described in a Deal Approval Sheet (Nuance), which was independently assessed by RAC analysts. Deals required various levels of approval from numerous departments, including blessing from the well-nigh senior levels, fifty-fifty from the board of directors.

Enron's Performance Review System: Another vital link in Enron's direction controls was the Peer Review Committee (Cathay) organization. The intention of the Red china system was to align employee action with the visitor's strategic objectives, retaining and rewarding superior performers on a off-white and consistent basis. Under the PRC organisation, every 6 months each employee received a formal performance review, based on formal feedback categories including revenue generation, and was assigned a final marking from one to 5 (the employee's photo was displayed on a screen). Feedback came from diverse sources including the employee'southward boss, as well as from five co-workers, superiors or subordinates that the employee selected. The bottom fifteen percentage, no matter how good they were, received a "5" which automatically meant redeployment to "Siberia," a special area where they had two weeks to try to find some other task at Enron. If they did not – and most did not – it was "out the door."

Code of Ethics: Enron'southward code served equally a behavioral control intended to prohibit a range of unethical behaviors. The code stressed the following iv key principles: advice, respect, integrity and excellence, and included phrases such as "we treat others as we would like to be treated ourselves", "we do non tolerate abusive or disrespectful handling" and "nosotros work with customers and prospects openly, honestly and sincerely". The lawmaking, which each employee signed on joining Enron and annually re-affirmed, proved to exist of wide interest – so much and so that the political history division of the Smithsonian National Museum of American History acquired information technology for its permanent exhibit of exemplary business practices.

Enron also had in identify the usual corporate governance mechanisms including a well-credentialed board of directors, an audit and compliance commission, a Big-5 external accountant (the sick-fated Arthur Andersen), an part of the director of financial disclosure, a chief risk officer'due south office, a finance commission, and the SEC's normal oversight. In sum, the control infrastructure within Enron was carefully designed, comprehensive and cut edge. How this infrastructure was systemically subverted, marginalized and ignored under the leadership of Jeffrey Skilling offers key insights for practitioners and regulators akin.

Linkage ii: Jeff Skilling's function in crafting corporate culture at Enron

By mid-2000, Jeff Skilling had achieved his goal: Almost all the vestiges of the old Enron … were gone. In its identify, Enron had become a trading company. And with that change came a rock-em, sock-em, fast-paced trading culture in which deals and 'deal period' became the driving force behind everything Enron did. (R. Bryce, Pipe dreams: Greed, ego, and the decease of Enron, Public Affairs)

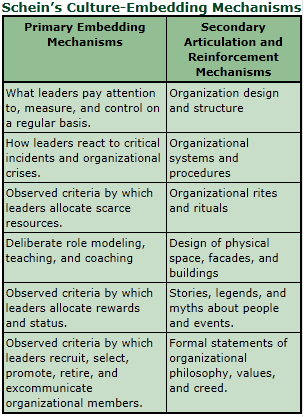

Equally Edgar Schein argues, leadership is critical to the creation and maintenance of culture; there is a constant interplay betwixt culture and leadership. Within companies, cultural norms ascend and change due to what leaders tend to focus their attention on, their reactions to crises, their part modeling, and their recruitment strategies. Leader's visions provide the substance of new organizational culture. To sympathize how the management controls at Enron were subverted, we must not just recognize the nature of Jeff Skilling's tenure as company CEO, but also Enron's shift to a Wall Street-type options and futures trading business firm (i.due east., a financial engineering store). Schein's leadership framework outlined in the diagram beneath charts how Skilling's agency was instrumental in creating an environment that came to pervade and degrade Enron's management controls.

Skilling's leadership style had emerged over a number of years. As early on as loftier schoolhouse Jeff Skilling held a reputation equally non only a scholar, but one with a penchant for somewhat unsafe activities, a characteristic that resurfaced afterwards at Enron. Later thriving at the highly competitive Harvard Business School, where he excelled as a acme scholar, Skilling joined the Houston office of McKinsey & Company, where his intellect and tenacity impressed many clients, among them Ken Lay.

Skilling's leadership style had emerged over a number of years. As early on as loftier schoolhouse Jeff Skilling held a reputation equally non only a scholar, but one with a penchant for somewhat unsafe activities, a characteristic that resurfaced afterwards at Enron. Later thriving at the highly competitive Harvard Business School, where he excelled as a acme scholar, Skilling joined the Houston office of McKinsey & Company, where his intellect and tenacity impressed many clients, among them Ken Lay.

Skilling impressed Lay when he proposed forming a "Gas Bank", which took reward of the fact that the short-term demand and supply for gas was chronically out of residuum. The thought proved an instant success and moved Lay to rent Skilling as caput of its trading operations, Enron Finance Corporation (EFC). Eventually, in 1996, Jeffrey Skilling would supplant Richard Kinder as the CEO of Enron. Nether Skilling's reign every bit President and CEO, a very different direction command style ensued and elements of Enron's culture and operations underwent a radical transformation.

Inside a few short years, Enron'south business organization model shifted towards a Wall Street-blazon fiscal applied science trading platform operating in energy futures but also expanding into financial commodities of all kinds. Past 2000, trading operations accounted for 99 percent of income, 88 percent of income before taxation and lxxx per centum of identifiable assets; reported acquirement increased from $eleven,904 million in 1996 to about $100,000 million in 2000 – a tenfold increase. Enron morphed into a total-scale Wall Street trading corporation specializing in the financial technology of derivatives, options and hedges involving commodities such as broadband, fibre optics and paper goods.

Skilling's leadership style

Many Enron insiders have commented on Skilling'south footprint on Enron's emerging organizational culture. Moreover, equally outlined in the diagram beneath, Edgar Schein's leadership matrix highlights how Skilling'southward leadership was critical in fashioning an organizational culture valorizing risk taking, a mercenary approach to profit making and a win-at-all costs trading approach.

Skilling'due south leadership style and vision were evident in a number of characteristics and traits that exemplified Enron's culture. Skilling exercised control over almost all facets of the organization, particularly regarding its bookkeeping procedures, which where designed to "massage" reported earnings in order to run across analysts' expectations. Earnings direction was achieved largely using special purpose entities (SPEs), accounting "reserves for contingencies" and mark-to-market accounting, which recorded profits from long-term deals immediately and, therefore, emphasized short-term results. These bookkeeping maneouvres, used widely in the banking and finance industries, meant that to continue to increase reported earnings at its current charge per unit, an e'er-greater volume of deals were necessary. This form of "cowboy capitalism" put enormous pressure level on the traders for short-term output.

Skilling'due south leadership style and vision were evident in a number of characteristics and traits that exemplified Enron's culture. Skilling exercised control over almost all facets of the organization, particularly regarding its bookkeeping procedures, which where designed to "massage" reported earnings in order to run across analysts' expectations. Earnings direction was achieved largely using special purpose entities (SPEs), accounting "reserves for contingencies" and mark-to-market accounting, which recorded profits from long-term deals immediately and, therefore, emphasized short-term results. These bookkeeping maneouvres, used widely in the banking and finance industries, meant that to continue to increase reported earnings at its current charge per unit, an e'er-greater volume of deals were necessary. This form of "cowboy capitalism" put enormous pressure level on the traders for short-term output.

The importance of earnings in Skilling's leadership style is unmistakable, especially in the reactions to critical incidents and organizational crises. For instance, show emerged at Skilling's 2006 trial that Skilling and Richard Causey, Enron's primary accounting officer, had decided to change the numbers to meet the new analysts' consensus, which had risen from thirty cents to 31 cents. Accordingly, Wesley and Colwell, principal auditor of Enron's wholesale energy trading unit of measurement, transferred $seven million to a profit account from a reserve contingency account ready in a prior menses equally a reserve for possible future contract settlements.

Another critical trait of Skilling's leadership fashion was the importance of rewards and status. Compensation plans, a powerful shaper and emblem of Enron civilisation, had one purpose in heed — to enrich the executives, non to enhance profits or increase shareholder value. For stock selection incentives, Enron added the status that if profits and stock prices increased sufficiently, vesting schedules could be rapidly advanced, meaning executives could become their easily on the stock more quickly. Skilling handed out extremely large pay cheques, bonuses and stock options to traders who met their earnings targets; in 1999, Enron granted 93.5 1000000 stock options compared with 25.4 in 1996. John Arnold, a gas trader, booked $700 million in 2001, took his $15 meg bonus and left Enron. Lou Pai cashed $250 1000000 in Enron stock over three years.

Skilling's leadership style also included deliberate role modelling, teaching and coaching, which involved exposing employees to exaggerated claims. In 2000, for instance, Enron draped a huge banner at its entrance, enjoining employees to appoint in the procedure of transforming Enron "FROM THE Globe'S LEADING Free energy COMPANY – TO THE WORLD'South LEADING COMPANY." The pervasiveness of hype extended to the apply of metaphors drawn from war, sport and extremism. On bonus twenty-four hours, upscale car dealers set up shop around the Enron headquarters building showing the latest most expensive Mercedes, BMWs, Aston Martins, Blastoff Romeos and the like.

The concluding characteristic of Skilling'south leadership mode was borne out in how Enron recruited, selected and promoted employees. Skilling'due south shopping list for job candidate characteristics described a very smart, aggressive, glib extravert who could become a ruthless trader. Skilling hired but the "best and the brightest" traders, investment bankers, information and calculator experts, programmers, and financial engineers, most of whom were graduates of prestigious universities. As part of his Analyst and Assembly' Program, Skilling would annually rent from 250 to 500 newly minted MBAs from the top business organisation schools in the country. Promotions and transfers came quickly, without providing time to learn industry details. Those who did not produce deals were quickly redeployed and soon after, often, terminated.

Linkage 3: The Way in Which Corporate Civilisation Came to Subvert Management Controls at Enron

Skilling used numerous methods to reshape organizational culture in a mode that celebrated attempts to exploit and "bend the rules," often through the subversion of management controls. Under Skilling, an extreme performance-oriented culture that both institutionalized and tolerated deviant behaviour emerged. The lauding of "creative take chances-taking" and "revolution" led to not only stretching, but also circumventing and breaking legal and ethical boundaries. Resistance to bad news created an important pressure indicate on information sharing internally and externally. Vehement internal competition coupled with huge incentives led to private information, deceit and all-encompassing efforts to bolster short-term operation. The civilisation that evolved under Skilling, and its impact on Enron's command systems, strategy and operating surroundings can possibly best exist understood by the comparison, as illustrated below, to that which existed under Richard Kinder.

As Enron entered market areas where information technology did not enjoy a comparative reward, its mercenary corporate culture combined with the subverted control infrastructure meant that Enron lost its ability to keep track of relevant risks. Skilling was able to bring together a number of structural factors that enabled the Enron expansion and re-branding of its corporate image: deregulation, the loftier-tech investment chimera, enhancements in technological capabilities and a hungry and increasingly expectant investment community. Although at that place were favourable developments in Enron's institutional environment, Skilling largely brought these elements together in a cohesive package and promoted a culture celebrating creative bargain making, innovation, entrepreneurship and mercenary practices.

As Enron entered market areas where information technology did not enjoy a comparative reward, its mercenary corporate culture combined with the subverted control infrastructure meant that Enron lost its ability to keep track of relevant risks. Skilling was able to bring together a number of structural factors that enabled the Enron expansion and re-branding of its corporate image: deregulation, the loftier-tech investment chimera, enhancements in technological capabilities and a hungry and increasingly expectant investment community. Although at that place were favourable developments in Enron's institutional environment, Skilling largely brought these elements together in a cohesive package and promoted a culture celebrating creative bargain making, innovation, entrepreneurship and mercenary practices.

The People's republic of china system, meanwhile, worked to encourage private networks of loyal employees who gravitated towards powerful players for protection. Even though very knowledgeable risk management personnel staffed the RAC Group, over time they became increasingly reluctant to turn dorsum projects that looked bad, since the corporate ethos held that the driving strength of its business model was its ever-growing flows of deals. Rejecting them often meant "political expiry" for RAC members since the projection proposal people could lose their bonuses and so would take revenge during the PRC process. Moreover, they were not inclined to refuse proposals for fear of real repercussions from Skilling.

Every bit old employees Peter Fusaro and Ross Miller highlight in What Went Wrong at Enron: Everyone'due south Guide to the Largest Bankruptcy in US History, Enron's 'rank-and-yank' machinations created "an environment where employees were afraid to express their opinions or to question unethical and potentially illegal business practices. Because the rank-and-yank system was both arbitrary and subjective, it was hands used past managers to advantage bullheaded loyalty and quash brewing dissent." The Red china was a powerful mechanism for preventing the emergence of any subcultures that might run counter to the mercenary organizational tone gear up by Skilling's leadership.

Enron'south bonus authorities, a central machinery aimed at adjustment individual and corporate goals, exacerbated the competitiveness of the Skilling-designed Red china as employees used several tactics to manipulate the system. An of import consequence of this, and one that would play a big role in Enron'southward demise was that traders started to push through over-valued deals. Sometimes they would alter the price projections at the last minute before signing the contracts in order to favour their brusque-term trades at the expense of the originators' long-term contracts. Skilling's People's republic of china had a Darwinian nature since it instilled a competitive streak in every employee.

Thus, the reality of Enron'due south business practices flew in the face of its Code of Ethics. By mid-2006, some sixteen Enron accounting and finance managers, including CFO Andrew Fastow, had pleaded guilty to diverse criminal offences, including fraudulent accounting practices and manipulating quarterly earnings reports. The contrast between Enron's moral mantra and the behaviour of some of its executives was startling.

What Enron clearly demonstrates is that once employees align themselves with a particular corporate civilisation – and invest heavy commitment in organizational routines and the wisdom of leaders – they are liable to lose their original sense of identity, and tolerate and rationalize ethical lapses that they would have previously deplored. One time a new and possibly corrosive value organization emerges, employees are rendered vulnerable to manipulation by organizational leaders to whom they have entrusted many of their vital interests. The Enron demise, then, points to numerous risks associated with degenerate cultures: the risk that a culture motivating and rewarding creative entrepreneurial bargain making may provide stiff incentives to take additional risks, thereby pushing legal and ethical boundaries; resistance to bad news creates an important pressure point of culture; and internal competition for bonuses and promotion tin can atomic number 82 to private information and gambles to bolster brusk-term functioning. At Enron, these risks ultimately subverted the company's elaborate spider web of controls.

Lessons for Managers

Enron offers a number of important insights for managers. Firstly, it underlines the vital function of top management leadership in fostering organizational culture. The footprint of Jeffrey Skilling is conspicuous in all accounts of Enron's organizational civilisation. Enron'due south plight as well highlights the vulnerability of rank and file employees to prevailing cultural norms, morals and sanctions. Especially in the absenteeism of counteracting forces or dissenting opinions, increasing identification with an arrangement'southward cultural values is likely. Andy Fastow, the erstwhile main financial officer of Enron, responded to a scathing cross-examination past stating, "Inside the culture of corruption that Enron had, that valued financial reporting rather than economic value, I believed I was being a hero." During his trial, Marking Koenig, Enron's former caput of investor relations, told jurors "I wish I knew why I did information technology. I did information technology to continue my chore, to keep the value that I had in the company, to keep working for the company. I didn't have a practiced reason."

Secondly, within organizations, the impact of culture and leadership on even near the sophisticated direction control system must not be overlooked or minimized. It is often besides easy to consider cultural and direction control systems separately, with cultural being a soft upshot and direction controls a hard 1. Managers must always remember that a culture created through a reckless and overly aggressive leadership way tin can lead to individuals taking actions that can subvert even state-of-the-art management controls. Organizations demand to distinguish more than carefully between leadership styles such every bit that of Kinder, which expected high but fair performance and those that need excessive and ultimately unattainable levels of functioning.

Finally, the Enron saga speaks to the importance of not abandoning professional integrity. Mayhap, the most important lesson for managers to accept abroad is to use personal cultural capital to detect a working environment that matches one'south personal values and principles. If they don't match, one should leave and find a company that does. As with the Challenger disaster in our epigraph, Enron should be a wake-up phone call for managers in all organizations.

Which Of The Following Is An Example Of Formal Management Controls?,

Source: https://iveybusinessjournal.com/publication/management-controls-the-organizational-fraud-triangle-of-leadership-culture-and-control-in-enron/

Posted by: knorrkeircolty.blogspot.com

0 Response to "Which Of The Following Is An Example Of Formal Management Controls?"

Post a Comment